FXgram The Ugly Truth About Trading Related Posts 02 June 2024 Sky-Tide Read More Trade Future With A Plus If you’re new to the trading scene and make an annual income below $250,000, I recommend you move on, as most regulatory bodies may not consider the investing activities suitable for you due to the risks involved, until… you’re ready to do your homework. FREE DEMO Plus500 Published by FXgram on December 10, 2024 Starting out, you want to really understand the basics of reading candles, charts (technical analysis) and practice on the Plus500 platform that allows the unlimited paper trading (not just a 2-week demo account). If I were new in your shoes, I would do the following: Read the candlestick bible until page 111 (after it goes into strategy). As you go through the material, look through the live charts to get an idea of how things move, etc. The candlestick PDF can be found online for free; you can search it up. After you finish this, you will want to start learning the strategy. Linked below is the Futures Academy with free educational licensed videos and articles. Paper trade using the above information to practice taking trades as you develop your system, finding out what works best for you, etc. You really want to collect as much data as possible to understand what works, what doesn’t work, what to improve on, what to avoid, etc. After a few weeks of consistent paper trading success (making more than you lose), consider trading with real money. Be prepared for the challenge of trading psychology. You’ll face emotions like greed and fear, and discover a lot about yourself. Use this as an opportunity to grow – not just as a trader, but as a person. Lastly, take your time! It is a lot of material to go over, it can be confusing at first but as you get in screen time. You will eventually be able to understand it. If you can spend at least an hour a day that would be fantastic. That’s it. Good luck on your trading journey – you’ve got this! Try futures trading with Plus500: FUTURES ACADEMY TRY FREE DEMO Get a Bonus With Your First Deposit T&Cs apply FXgram The Ugly Truth About Trading Related Posts 02 June 2024 Sky-Tide Read More Terms And Conditions Privacy Policy IMPORTANT: Trading with leverage comes with a high risk and may not be suitable for everyone. The valuation of futures and options contracts may fluctuate rapidly and unpredictably, and, as a result, clients may lose more than their original investments. In no event should the content of this website be construed as an express or implied promise or guarantee by or from Gramatik Ltd that you will profit or that losses can or will be limited in any manner whatsoever. Information provided in this correspondence is intended solely for informational purposes and is obtained from sources believed to be reliable. Information is in no way guaranteed. Follow us:

Category: BlogPage

A Day In Life Of A Forex Trader

FXgram The Ugly Truth About Trading Related Posts 09 June 2024 Being Born Poor Is Not Your Fault Does it have a ‘slap-in-the-face’ effect on you? Then it’s time to take action and… Read More 02 June 2024 Sky-Tide Marketing SkyTide – the official news publication of Gramatik LTD. SkyTide – the… Read More 28 May 2024 Big Short’s Michael Burry bets against S&P 500 and Nasdaq 100 Michael Burry, the hedge fund manager that inspired Martin Lewis’s book The Big Short,… Read More 20 June 2023 UK billionaire Hamish Harding on board missing Titanic submersible UK billionaire Hamish Harding is one of five people on board a missing tourist submersible… Read More A Day In The Life Of A Forex Trader Hi everyone! Today, I’m excited to take you through a typical day in my life as a Forex trader. If you’re new to trading or have had a rocky experience in the past, I hope my story can shed some light on what it’s really like to trade Forex. Published by FXgram on June 11, 2024 Open a trading account with a Broker right now OPEN Read the Risk Warning before you register Morning Routine: Success Mindset My name is Matt, I’m a professional trader and I have been living in Bali for almost 8 months. If you are a trader or interested in Forex please read this article until the end. My day starts early at 6 AM. The first thing I do is grab a cup of coffee and check the latest market news. I follow several financial news websites to get a sense of the market sentiment and any overnight developments that might affect my trading strategy. For instance, on March 1, 2024, I came across news that geopolitical tensions and ongoing robust central bank purchases provided strong foundational support for the gold rally. Central banks, including India’s Reserve Bank, continued to add to their gold reserves. Knowing this, I immediately pulled up the XAU/USD chart to analyze the potential market movements. The chart from that morning showed a consolidation pattern, indicating that traders were waiting for more information before making any major moves. By 7 AM, I’m at my desk, reviewing these charts and analyzing trends. Here’s what I saw: Support and Resistance Levels: The chart showed a strong resistance level at $2,055. The contributing factor was a surge in technical buying. Gold broke through several psychological and technical resistance levels, which spurred additional investment from traders covering short positions and those seeking to capitalize on the upward momentum. Candlestick Patterns: I also noticed a series of doji candles forming near the resistance level in previous days. This often precedes a breakout or a reversal, making it a critical point to watch. Simple Moving Averages: The price remained above 50-day, 100-day, and 200-day averages, thus indicating an uptrend, suggesting bullish sentiment in the market. Volume Indicators: There was an increase in trading volume during the Asian trading session, coinciding with the news of the potential interest rate hike. Higher volume often confirms the strength of a price movement, whether it’s up or down. Economic Calendar: A weak ISM manufacturing report in the U.S. could become a crucial trigger but given the unpredictable nature of such events, it was essential to carefully calculate the associated risks. Based on these signals, I anticipated that the market would experience prevailing bullish sentiment. This analysis helped me prepare my trading strategy for the day. Trading Session: The Heart of the Day By 8 AM, I’m ready to start trading. My focus is on XAU/USD. With the news on the growing geopolitical tensions in mind, I placed a few strategic long positions on gold, anticipating a rise in its price. Risk management is a crucial part of my trading strategy. Before placing any trade, I ensure that I’m not risking more than 1-2% of my total account balance on a single trade. For this example, let’s say I have an account with $30,000. I decided to risk 1% of my account, which is $300. Given the leverage available, I was able to open a long position on XAU/USD. Open a trading account with a Broker right now OPEN Read the Risk Warning before you register Here are the trades I made throughout the day: 1. • Position size: 10 ounces • Entry price: $2,056 per ounce • Exit price: $2,071 per ounce • Profit per ounce: $15 • Total profit: $150 2. • Position size: 5 ounces • Entry price: $2,055 per ounce • Exit price: $2,053 per ounce • Loss per ounce: $2 • Total loss: $10 3. • Position size: 15 ounces • Entry price: $2,058 per ounce • Exit price: $2,072 per ounce • Profit per ounce: $14 • Total profit: $210 4. • Position size: 10 ounces • Entry price: $2,060 per ounce • Exit price: $2,078 per ounce • Profit per ounce: $18 • Total profit: $180 By the end of the day, my trades had yielded a total profit of $530. Here’s the breakdown of the profits and losses: Trade 1: $150 profit Trade 2: $10 loss Trade 3: $210 profit Trade 4: $180 profit Afternoon Routine: Reflect and Plan Ahead Around 2 PM, I take a break to have lunch and clear my mind. Trading can be intense, so it’s essential to step away and recharge. After lunch, I reviewed the trades I had made. The broker I use provides detailed reports and analytics, which help me understand my performance and areas for improvement. This data is invaluable for refining my strategies and becoming a better trader.By 4 PM, I start winding down my trading activities. I close out any remaining positions and review the day’s performance. This is also the time when I plan for the next day, setting up alerts and preparing for potential market movements. Evening Routine: Balancing Work and Life Evenings are my time to relax and unwind. I usually… Continue reading A Day In Life Of A Forex Trader

A Day In The Life Of A Forex Trader

FXgram The Ugly Truth About Trading Related Posts 09 June 2024 Being Born Poor Is Not Your Fault Does it have a ‘slap-in-the-face’ effect on you? Then it’s time to take action and… Read More 02 June 2024 Sky-Tide Marketing SkyTide – the official news publication of Gramatik LTD. SkyTide – the… Read More 28 May 2024 Big Short’s Michael Burry bets against S&P 500 and Nasdaq 100 Michael Burry, the hedge fund manager that inspired Martin Lewis’s book The Big Short,… Read More 20 June 2023 UK billionaire Hamish Harding on board missing Titanic submersible UK billionaire Hamish Harding is one of five people on board a missing tourist submersible… Read More A Day In The Life Of A Forex Trader Hi everyone! Today, I’m excited to take you through a typical day in my life as a Forex trader. If you’re new to trading or have had a rocky experience in the past, I hope my story can shed some light on what it’s really like to trade Forex. Published by FXgram on June 11, 2024 Open a trading account with a Broker right now OPEN Read the Risk Warning before you register Morning Routine: Success Mindset My name is Matt, I’m a professional trader and I have been living in Bali for almost 8 months. If you are a trader or interested in Forex please read this article until the end. My day starts early at 6 AM. The first thing I do is grab a cup of coffee and check the latest market news. I follow several financial news websites to get a sense of the market sentiment and any overnight developments that might affect my trading strategy. For instance, on March 1, 2024, I came across news that geopolitical tensions and ongoing robust central bank purchases provided strong foundational support for the gold rally. Central banks, including India’s Reserve Bank, continued to add to their gold reserves. Knowing this, I immediately pulled up the XAU/USD chart to analyze the potential market movements. The chart from that morning showed a consolidation pattern, indicating that traders were waiting for more information before making any major moves. By 7 AM, I’m at my desk, reviewing these charts and analyzing trends. Here’s what I saw: Support and Resistance Levels: The chart showed a strong resistance level at $2,055. The contributing factor was a surge in technical buying. Gold broke through several psychological and technical resistance levels, which spurred additional investment from traders covering short positions and those seeking to capitalize on the upward momentum. Candlestick Patterns: I also noticed a series of doji candles forming near the resistance level in previous days. This often precedes a breakout or a reversal, making it a critical point to watch. Simple Moving Averages: The price remained above 50-day, 100-day, and 200-day averages, thus indicating an uptrend, suggesting bullish sentiment in the market. Volume Indicators: There was an increase in trading volume during the Asian trading session, coinciding with the news of the potential interest rate hike. Higher volume often confirms the strength of a price movement, whether it’s up or down. Economic Calendar: A weak ISM manufacturing report in the U.S. could become a crucial trigger but given the unpredictable nature of such events, it was essential to carefully calculate the associated risks. Based on these signals, I anticipated that the market would experience prevailing bullish sentiment. This analysis helped me prepare my trading strategy for the day. Trading Session: The Heart of the Day By 8 AM, I’m ready to start trading. My focus is on XAU/USD. With the news on the growing geopolitical tensions in mind, I placed a few strategic long positions on gold, anticipating a rise in its price. Risk management is a crucial part of my trading strategy. Before placing any trade, I ensure that I’m not risking more than 1-2% of my total account balance on a single trade. For this example, let’s say I have an account with $30,000. I decided to risk 1% of my account, which is $300. Given the leverage available, I was able to open a long position on XAU/USD. Open a trading account with a Broker right now OPEN Read the Risk Warning before you register Here are the trades I made throughout the day: 1. • Position size: 10 ounces • Entry price: $2,056 per ounce • Exit price: $2,071 per ounce • Profit per ounce: $15 • Total profit: $150 2. • Position size: 5 ounces • Entry price: $2,055 per ounce • Exit price: $2,053 per ounce • Loss per ounce: $2 • Total loss: $10 3. • Position size: 15 ounces • Entry price: $2,058 per ounce • Exit price: $2,072 per ounce • Profit per ounce: $14 • Total profit: $210 4. • Position size: 10 ounces • Entry price: $2,060 per ounce • Exit price: $2,078 per ounce • Profit per ounce: $18 • Total profit: $180 By the end of the day, my trades had yielded a total profit of $530. Here’s the breakdown of the profits and losses: Trade 1: $150 profit Trade 2: $10 loss Trade 3: $210 profit Trade 4: $180 profit Afternoon Routine: Reflect and Plan Ahead Around 2 PM, I take a break to have lunch and clear my mind. Trading can be intense, so it’s essential to step away and recharge. After lunch, I reviewed the trades I had made. The broker I use provides detailed reports and analytics, which help me understand my performance and areas for improvement. This data is invaluable for refining my strategies and becoming a better trader.By 4 PM, I start winding down my trading activities. I close out any remaining positions and review the day’s performance. This is also the time when I plan for the next day, setting up alerts and preparing for potential market movements. Evening Routine: Balancing Work and Life Evenings are my time to relax and unwind. I usually… Continue reading A Day In The Life Of A Forex Trader

Being Born Poor Is Not Your Fault

Does it have a ‘slap-in-the-face’ effect on you?

Then it’s time to take action and start investing in your future.

Big Short’s Michael Burry bets against S&P 500 and Nasdaq 100

Michael Burry, the hedge fund manager that inspired Martin Lewis’s book The Big Short, held more than $1.6bn in bets against the S&P 500 and Nasdaq 100 benchmarks at the end of Q2 following a blistering start to the year for US equities.

Rule 72 | Trading Academy

The impressive success story of Andy Krieger

الحصول على مليون دولار في سن 25 وابتكار طريقة ‘السلاحف’: قصة ريتشارد دينيس الاستثنائية

قصة ريتشارد دينيس الاستثنائية

วิธีการทำเงิน 300 ล้านดอลลาร์และทำให้สกุลเงินของประเทศล่ม: เรื่องราวของแอนดี้ ครีเกอร์ (Andy Krieger)

เรื่องราวของแอนดี้ ครีเกอร์

เรื่องราวอันน่าทึ่งของริชาร์ด เดนนิส: ทำเงินได้ 1 ล้านดอลลาร์ในวัย 25 ปีและสร้างวิธีการ ‘เต่า’

เรื่องราวอันน่าทึ่งของริชาร์ด เดนนิส

Cómo Ganar $300 Millones y Desplomar la Moneda de un País: La Historia de Andy Krieger

La Historia de Andy Krieger

Ganó $1 millón a los 25 años y creó el método de las ‘Tortugas’: La historia de Richard Dennis

La historia de Richard Dennis

How to Make $300 Million and Crash a Country’s Currency: The Story of Andy Krieger

The impressive success story of Andy Krieger

Made $1 Million at 25 and Created the ‘Turtles’ Method: The Story of Richard Dennis

The incredible success story of Richard Dennis

Plan Your Retirement

How can you have the retirement you’ve always wanted? Consider ways to boost your pension.

Plan Your Retirement

How can you have the retirement you’ve always wanted? Consider ways to boost your pension.

Plan Your Retirement

How can you have the retirement you’ve always wanted? Consider ways to boost your pension.

Being Born Poor Is Not Your Fault

Does it have a ‘slap-in-the-face’ effect on you?

Then it’s time to take action and start investing in your future.

Being Born Poor Is Not Your Fault

Does it have a ‘slap-in-the-face’ effect on you?

Then it’s time to take action and start investing in your future.

Big Short’s Michael Burry bets against S&P 500 and Nasdaq 100

Michael Burry, the hedge fund manager that inspired Martin Lewis’s book The Big Short, held more than $1.6bn in bets against the S&P 500 and Nasdaq 100 benchmarks at the end of Q2 following a blistering start to the year for US equities.

Big Short’s Michael Burry bets against S&P 500 and Nasdaq 100

Michael Burry, the hedge fund manager that inspired Martin Lewis’s book The Big Short, held more than $1.6bn in bets against the S&P 500 and Nasdaq 100 benchmarks at the end of Q2 following a blistering start to the year for US equities.

Plan Your Retirement

How can you have the retirement you’ve always wanted? Consider ways to boost your pension.

Being Born Poor Is Not Your Fault

Does it have a ‘slap-in-the-face’ effect on you?

Then it’s time to take action and start investing in your future.

Plan Your Retirement

How can you have the retirement you’ve always wanted? Consider ways to boost your pension.

Plan Your Retirement

How can you have the retirement you’ve always wanted? Consider ways to boost your pension.

Being Born Poor Is Not Your Fault

Does it have a ‘slap-in-the-face’ effect on you?

Then it’s time to take action and start investing in your future.

Being Born Poor Is Not Your Fault

Does it have a ‘slap-in-the-face’ effect on you?

Then it’s time to take action and start investing in your future.

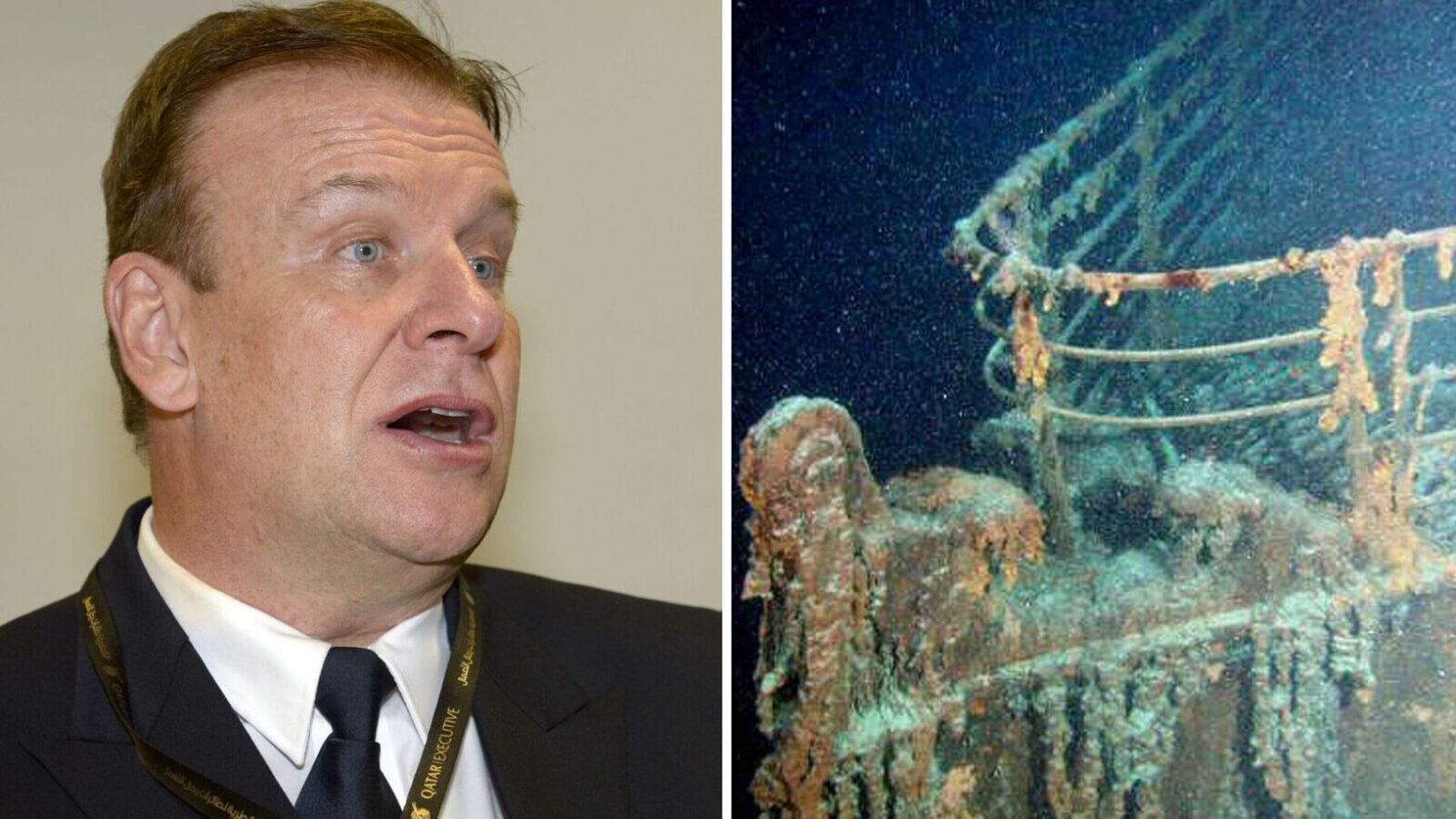

UK billionaire Hamish Harding on board missing Titanic submersible

UK billionaire Hamish Harding is one of five people on board a missing tourist submersible used to take people to see the wreck of the Titanic.

UK billionaire Hamish Harding on board missing Titanic submersible

UK billionaire Hamish Harding is one of five people on board a missing tourist submersible used to take people to see the wreck of the Titanic.

UK billionaire Hamish Harding on board missing Titanic submersible

UK billionaire Hamish Harding is one of five people on board a missing tourist submersible used to take people to see the wreck of the Titanic.

UK billionaire Hamish Harding on board missing Titanic submersible

UK billionaire Hamish Harding is one of five people on board a missing tourist submersible used to take people to see the wreck of the Titanic.