FXgram

The Ugly Truth About Trading

Related Posts

Making $1 million at 25 and creating the 'Turtles' method: The extraordinary tale of Richard Dennis

Richard Dennis is a legend in the world of trading, having experienced both soaring highs and catastrophic lows. Not only did he achieve great success himself, but he also taught many others how to trade on the stock market. This is his story.

Published by FXgram on March 5, 2023

Open a trading account

with a Broker right now

Read the Risk Warning before you register

Dropped out of School for Trading and Earned

$1 Million by 25

The stories of successful traders often seem like a continuous upward journey: a talented guy gradually learns and earns on the stock exchange, then makes the “deal of a lifetime” and becomes a trading legend, after which he either retires into obscurity or writes an autobiography and instructional books. But Richard Dennis’s path was not that simple. His career developed splendidly, but the infamous Black Monday of 1987 nearly bankrupted him, led to severe depression, and forced him out of the market — only to return years later as a winner. He also inspired numerous traders and taught them to earn in the market.

Dennis began trading as a teenager. At 17, he worked as a runner at the Chicago Mercantile Exchange (CME) for $40 a week over the summer. Since trading was prohibited for those under 21, transactions were made in his father’s name, who worked as a janitor for a municipal service — formally, Richard was listed as his assistant. He borrowed the money for trading from him — his father, who supported his son’s interest, allocated $400.

After the first hour of trading, he lost a week’s earnings — an ‘achievement’ he repeated more than once. But Richard quickly realized that he needed his own high-return strategy. Dennis later said that “the knowledge gained back then came surprisingly cheap.”

After that, his studies became less interesting to him. He continued to trade, making deals over the phone. As soon as Dennis came of age, he dropped out of graduate school, got a spot on the Mid-American Commodity Exchange, and began trading small contracts. For this, he borrowed $1,600 from relatives, of which $1,200 went on purchasing a seat, and another $400 became the starting capital. He mainly traded soybean futures. The first year of trading brought him $3,000 and taught him to avoid rash decisions, unthought attempts to recoup losses, and blindly following the majority — for example, one day he lost a third of his deposit. By 1973, his capital had grown to $100,000, and in 1974, he traded up to $500,000 — by 25, trading had brought him his first million dollars.

Soon he realized that he could earn more and switched to the Chicago Board of Trade, and also founded the Drexel Fund. He was one of the most successful and grew so fast that Dennis was dubbed the “King of Futures” — when he bought an asset, it immediately began to rise in price. By the early 1980s, Dennis had already earned more than $100 million. According to legend, his father then said: “Looks like Richie did quite well for himself on those $400.”

Dennis Became Famous Thanks to His Unique Strategy, Making Millionaires of Its Followers

Dennis’s success is explained by his trading strategy, which he kept secret. But it later gained worldwide fame thanks to a famous experiment. In 1983, Richard and his friend — trader and millionaire William Eckhardt — disagreed on the necessary qualities for a successful trader and made a bet for $1. If Eckhardt believed that only people with strong intuition could trade, Dennis was convinced that a profitable trader could be anyone with basic knowledge, rules, and discipline to follow them. William did not believe that trading could be taught without innate abilities and instincts. But Dennis decided to prove him wrong.

Open a trading account

with a Broker right now

Read the Risk Warning before you register

Richard placed an advertisement in the Wall Street Journal and New York Times, offering anyone the opportunity to learn trading, even promising a salary. The applicant’s resume had to be limited to one sentence explaining their desire to engage in trading.

After several tests and interviews, he selected 13 people, including individuals from various professions — from a security guard and card players to a fantasy game designer and financial consultant. Among them was also one woman — female traders were a rarity at the time. He taught them the “Turtles” strategy for two weeks — that’s what he called his group. Its essence was to open a new deal with an upward trend reversal and close it as soon as the market turned down, without waiting for significant losses. The goal was to maximize coverage of the long-term upward trend.

After this training, he gave each of them $1 million of his own funds to trade. The rules were clear: students could not use any other money and were allowed a maximum of 12 transactions per month. However, they were not limited in their choice of instruments. 85% of the profits were allocated to Richard, and students could keep 15%.

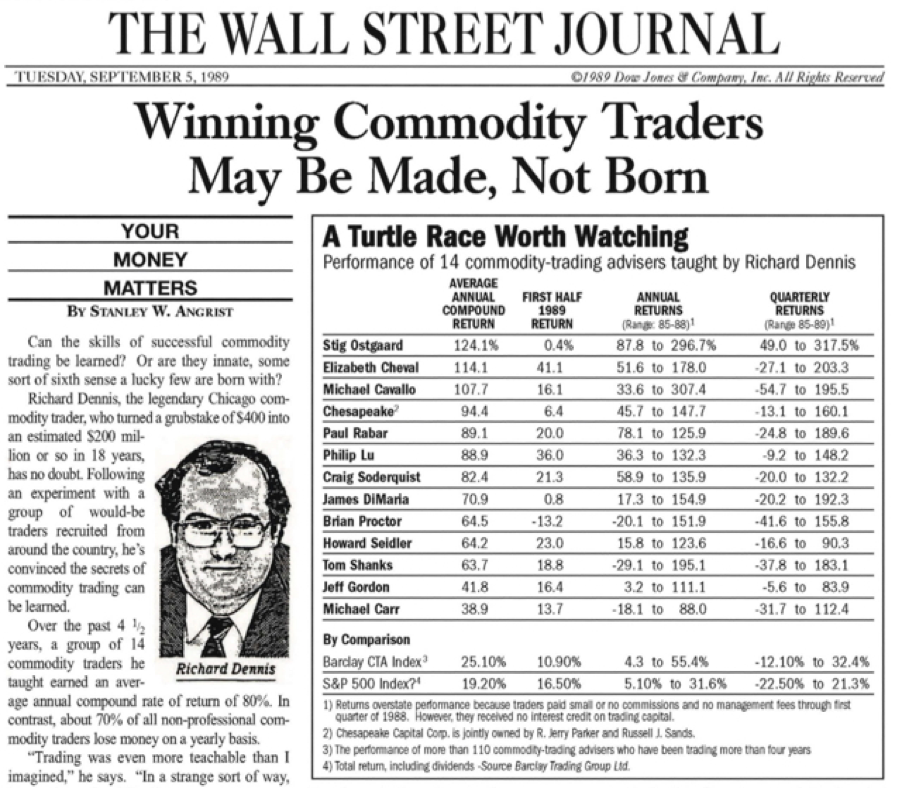

Dennis won the bet: almost immediately, 10 out of 13 “Turtles” achieved profitability around 100%, and the three underperformers were “dismissed.” A year later, they and Eckhardt gathered a second group of ten people, who also began to consistently earn. In total, 23 “Turtles” over five years collectively enriched themselves by $175 million.

Black Monday Brought Huge Losses to Dennis and Almost Broke His Career

In 1986, Dennis earned $80 million — but his career was not just a string of luck. The famous Black Monday of 1987 was truly black for Richard and his fund. That day, October 19, there was the largest drop in the Dow Jones index in its entire history (-22.6%), collapsing stock markets around the world.

Suddenly, Dennis himself deviated from his own strategy and made several risky transactions. They did not pay off and resulted in tens of millions of dollars in losses (about 50% of his assets) — Richard lost both his and his clients’ money.

The Drexel Fund had to be closed — at that time, 14 “Turtles” were left without work as part of the experiment. However, the knowledge they gained helped them start fully independent trading, establish their own firms, and even finish that year in the black. Over the next few years, some “Turtles” even became among the best traders, surpassing their teacher.

Dennis fell into depression, took a long break from trading, and forever refused to manage investor funds. Most of the losses in 1987 were other people’s assets — investors were so dissatisfied with Richard that they sued him for suspected fraud. But in the end, Dennis proved that there was no malice in his actions.

Returned to the Stock Exchange After Years and Became Super Successful Again

Although Richard swore never to approach the stock exchange again, he returned to the market — but only in 1994 and with a new strategy. The trader bet on mechanical trading systems, where transactions are made by a computer program written by a person. He called this “the only way to win in the futures market.”

Initially, it was not very successful (+8% by the end of 1994), but in the next two years, trading robots brought him 108% and 112% profitability, respectively. By 2000, he had already earned $300 million — remember, he started in 1970 with $400.

Success freed Richard from depression, and although he traded again, he called himself not a trader but a market researcher.

Dennis did not retire until his death: he worked as president of Dennis Trading Group Inc, held high positions at the Cato Institute and C&D Commodities. He was also an associate editor at Economic Review and wrote articles for major financial publications such as the New York Times and The Wall Street Journal. He also authored many educational texts and programs.

He donated a lot to political and charitable causes. Also, he was a very private and shy person who never married.

Richard Dennis died of cancer on September 17, 2012. But he certainly lived a life not in vain — his “Turtles” strategy not only became popular but motivated many people to start trading on the stock exchange and proved that anyone can become a successful trader.

Open a trading account with a Broker right now

Read the Risk Warning before you register

Find more interesting stories and news about investments on our subreddit XGramatikInsights.

FXgram

The Ugly Truth About Trading

Related Posts

Risk Warning: Trading Forex and Leveraged Financial Instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives, and seek independent financial advice if necessary. It is the responsibility of the Client to ascertain whether he/she is permitted to use the services of the website based on the legal requirements in his/her country of residence.