What's Wrong

With Wall Street?

The secret behind the stock market is simple:

It's All A Big Lie!

This is the U.S. Federal Debt.

$35,855,877,350,221.00

Noticed anything? Yes, it's growing $115,700

per second

Over the last 20 years, the U.S. national debt has skyrocketed, creating ripples that affect every corner of American life. In the year 2000, the debt stood at roughly $5.6 trillion. Fast forward to today, and it’s soared beyond $34 trillion, with the latest $1 trillion increase occurring in approximately 100 days!

Is the Stock Market on Thin Ice?

See it for yourself: how it's similar to the 2000s dot-com bubble now

They Say — We Read Between the Li(n)es

In a world where financial news swirls with conflicting reports and economic forecasts, it's crucial to discern fact from fiction. Here, we confront recent misleading statements by U.S. federal representatives about the economy, providing you with the truth backed by hard data

They Say:

"The economy is in a strong recovery phase."

Reality Check:

The GDP recovery has been uneven, with certain sectors like retail and hospitality still lagging significantly behind pre-pandemic levels. Inflation rates soared to 7%, the highest in nearly four decades, eroding the people's purchasing power

They Say:

"Inflation pressures are transitory and under control."

Reality Check:

Inflation persisted wellinto 2023, affecting essential items such as food and housing. The Consumer Price Index (CPI) indicated a 6.5% increase year-over-year, significantly impacting household budgets across the country

They Say:

"Job market strength shows economic health."

Reality Check:

Despite low unemployment figures, wage growth failed to keep pace with inflation, and the labor participation rate remained below pre-pandemic levels, suggesting that many people had stopped looking for work or settled for lower-paying jobs.

They Say:

"The stock market mirrors the economy."

Reality Check:

Stock markets can surge due to speculative activity or policy changes, often not aligning with real economic struggles like joblessness or wage stagnation.

2008: Turning Crisis into Opportunity

The 2008 financial crisis was a catastrophic event that shook the global economy, but it also presented unique opportunities for those who understood how to navigate the turmoil. Here's a closer look at how savvy investors turned one of the worst economic downturns into profitable ventures*:

Short Selling

As housing markets crumbled and banks faltered, some investors anticipated the downfall and profited by short selling. They bet against the market, expecting prices to fall, which they did dramatically.Buying Distressed Assets

During the crisis, asset prices plummeted. Sharp-eyed investors acquired high-quality assets at significantly reduced prices. When the market eventually recovered, these assets regained their value, yielding substantial returns.Diversification and Hedging

Smart investors diversified their portfolios to mitigate risks. They invested in gold, government bonds, and other safe-haven assets that typically hold or increase in value during market downturns.* These are examples and not an investment advice

Who Was Able To Predict The Crisis

John Paulson

Strategy: Foresaw the subprime mortgage crisis and bet against mortgage-backed securities by investing in credit default swaps

Gain: Over $15 billion profit

Warren Buffett

Strategy: Purchased preferred shares in distressed but fundamentally strong companies like Goldman Sachs and General Electric

Gain: Earned billions in dividends and capital gains as markets stabilized

George Soros

Strategy: Recognized early signs of economic recovery and invested heavily in equities and currencies that would benefit

Gain: Gained approximately $1.1 billion in 2009 alone

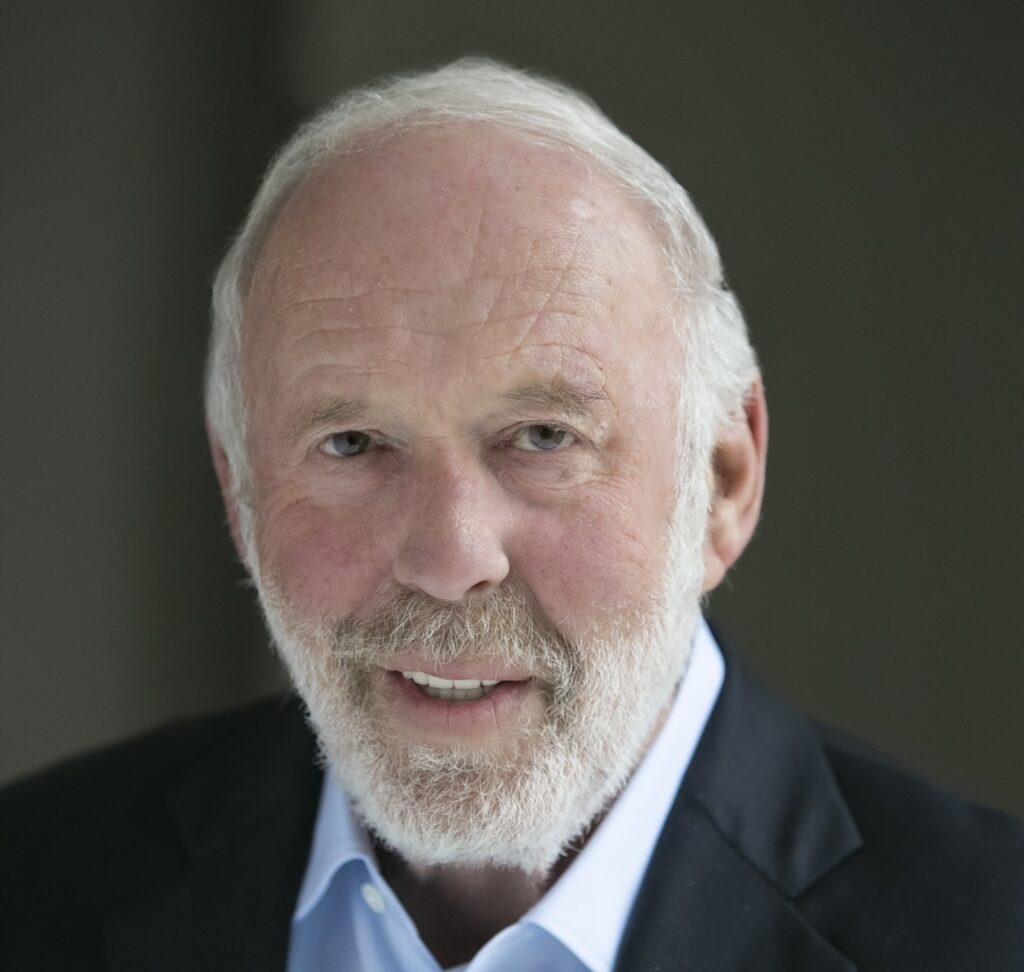

James Simons

Strategy: Leveraged quantitative models to exploit market inefficiencies during the crisis

Gain: His fund, Renaissance Technologies, reportedly returned more than 80% in 2008, benefiting from the high volatility of the market

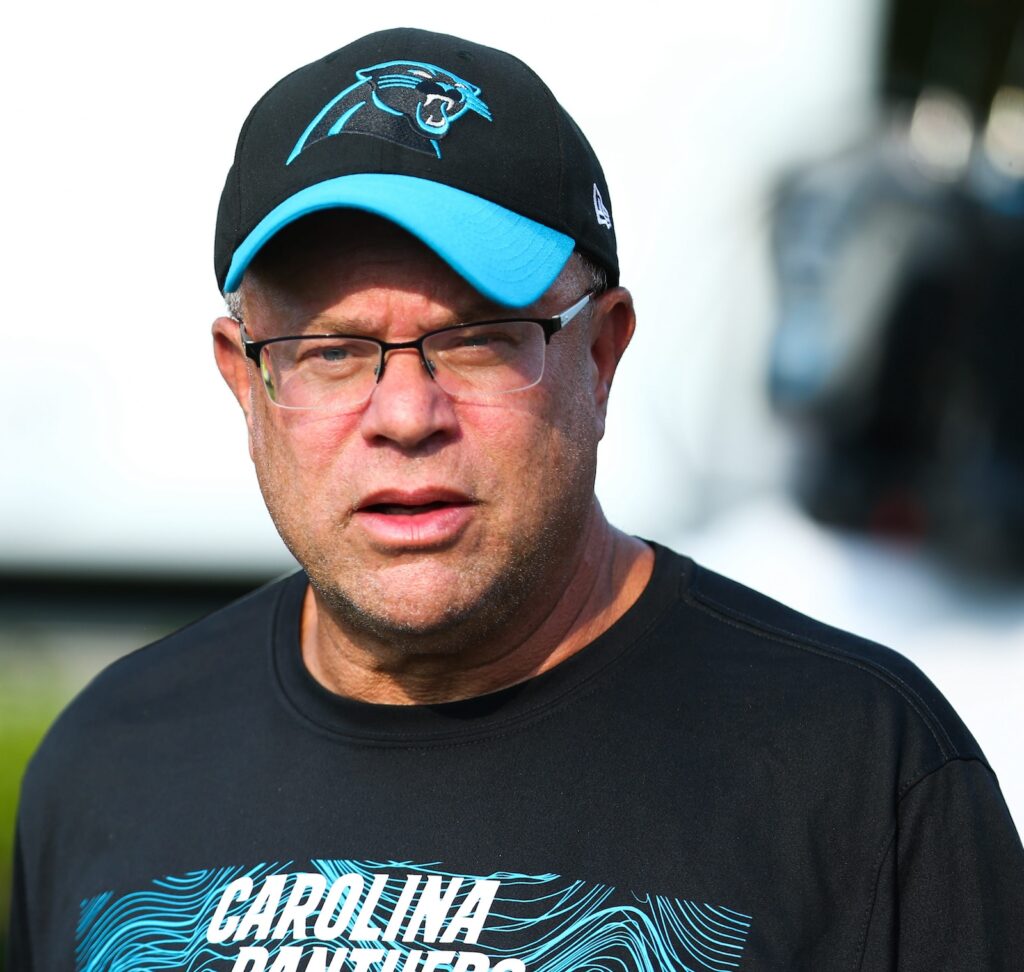

David Tepper

Strategy: Bought distressed stocks, especially in the banking sector, when markets were at their lowest

Gain: His fund, Appaloosa Management, gained about $7 billion by betting on banks and other financial stocks to rebound after the crash

Michael Burry

Strategy: One of the first investors to recognize and profit from the impending subprime mortgage crisis, using credit default swaps to bet against the housing market

Gain: His accurate predictions and investments brought in over $700 million for his fund, Scion Capital, and personal profits of $100 million

Back in 2008, a bunch of outsiders looked into the financial market and found that it was holding on to a great lie. Sounds familiar, doesn’t it? So what they did was play against the market!

YOU CAN DO THAT, TOO

With a reliable broker who will provide you with all the information and the tools for the game. And then it’s only up to you, to decide how to play. Will you win? You never know unless you try

It is free and quick. In just a minute you can enter your new account!

The broker will always be there for you to help you around and answer any questions

Ready to Take Control? Start Your Investment Journey Today!

Risk Warning: Trading Forex and Leveraged Financial Instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives, and seek independent financial advice if necessary. It is the responsibility of the Client to ascertain whether he/she is permitted to use the services of the website based on the legal requirements in his/her country of residence.