SkyTide

Official publication resource of Gramatik LTD

Related Posts

How Does Money Even Happen? The Social Drama Behind Your Wallet

Ever wondered why a slip of paper or a metal coin is valuable? Money might seem like an obvious part of life, but it’s actually a social mystery wrapped in a fascinating story. In Chapter 2 of Capital, Marx unpacks how everyday products turn into “commodities” and why one specific commodity—money—ends up ruling them all.

Trading Up: How Commodities Emerge

Picture a farmer trading wheat for tools. When they exchange goods directly, it’s called barter. But as bartering grows, it gets tricky: what if the toolmaker doesn’t want wheat? The problem starts a chain reaction that pushes these items to become more than just stuff; they begin to embody value. Now they aren’t just useful—they represent a potential for future trade. This is the first step toward a product becoming a commodity: something you don’t just consume, but also exchange.

But even with commodities, there’s a catch. If everyone values their own goods as universal (wheat is worth all other things!), there’s no standard for trade. For the system to work, people need to agree on a single, universally accepted item as a yardstick for value.

The Great Compromise: Why Money Takes Over

When people trade, they face a problem: how can every commodity be equal if each person has different needs? To solve this, societies settle on one item—something convenient and durable—to stand as the universal equivalent. This role falls naturally to gold or silver, which can be divided, carried, and valued consistently.

This transformation doesn’t happen by magic; it’s a social evolution. For gold to become money, people must agree that it represents value consistently. Over time, this “social contract” strengthens, and gold becomes more than just metal. As Marx puts it, society “crystallizes” around gold or silver, turning them into the concrete forms of abstract value, i.e., money.

Think of it like the internet. The first online message was simple, but as the web evolved, it became the backbone of nearly all transactions. Gold, silver, and now paper money or even digital currency play a similar role: they make the complex system of trade simpler and faster, becoming essential in the process.

Money’s New Power: Beyond the Dollar Sign

Here’s where things get weird. Once society accepts a universal equivalent, money takes on a life of its own. Your dollar bill or credit card doesn’t just represent “some labor”; it’s a stand-in for value itself. We don’t see the labor that went into producing goods anymore—just the prices. This disconnection makes money seem almost magical, as if its value comes from nowhere. Yet, all this “value” ultimately traces back to human labor.

For example, imagine you’re holding a $20 bill. What’s it worth? In truth, its value lies in society’s shared belief that $20 can be traded for goods worth roughly the same amount of labor. It’s like a universal “like” button on social media that everyone understands. But just as likes don’t actually measure friendship or loyalty, money doesn’t inherently contain value—it just represents our collective agreement.

The Illusion of Money’s “Magic”

Money, Marx argues, is a product of human agreement, not nature. Yet, because we only see the final result, it seems like gold, silver, or paper currency just “has” value. This mystery of money, its power to buy, save, and “create” wealth, is really an illusion born from social interactions repeated millions of times.

If we zoom out, we realize that money doesn’t make the world go round—people and labor do. But by focusing on the money itself, we sometimes forget this crucial connection. When we pay $5 for coffee, we’re participating in a long chain of labor, from the farmer to the barista, but all we see is the dollar amount.

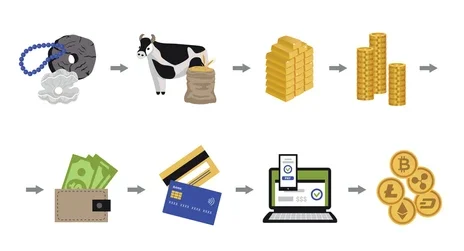

From Gold Coins to Credit Cards: The Story Continues

Today, we might use cards, apps, or crypto, but the underlying story of money is the same. It’s not “natural” for a digital code or a printed bill to be valuable; rather, they’re symbols that we’ve all agreed on. When we look at money today, we’re witnessing centuries of social trust, where people have collectively decided to use a single item as the ultimate trade chip.

So, next time you pull out cash or check your account, remember this: you’re holding more than just currency. You’re touching history, tradition, and a massive social agreement that gives each dollar its power. It’s not about the dollar itself—it’s about our trust in what it represents. And as society evolves, so does our shared idea of value.

Stay tuned as we dive deeper into the strange world of money and uncover more secrets of what makes our economy tick.

Open a trading account with a Broker right now

Read the Risk Warning before you register

Find more interesting stories and news about investments on our subreddit XGramatikInsights.

Risk Warning: Trading Forex and Leveraged Financial Instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives, and seek independent financial advice if necessary. It is the responsibility of the Client to ascertain whether he/she is permitted to use the services of the website based on the legal requirements in his/her country of residence.