SkyTide

Official publication resource of Gramatik LTD

Related Posts

From Linen to Bible: How Money Weaves the Fabric of Exchange

In the world of economics, money isn’t just a tool; it’s the engine driving a continuous, often unpredictable, flow of goods and services. Marx’s deep dive into “commodity metamorphosis” unravels why commodities like linen or wheat are not simply bought and sold but transformed in a circular movement that connects everyone’s exchanges into a vast, interdependent network. This process is more than simple barter—it’s the very framework that allows our economic system to thrive, and, at times, to falter.

The Transformation of Commodities: Not Just Trading, but "Metamorphosis"

When you buy a new smartphone, the purchase feels straightforward: money leaves your pocket, and you get a device in return. But Marx saw this exchange as part of a larger transformation, or “metamorphosis,” in which the phone moves through different forms and serves different needs across society.

- From Commodity to Money: First, the seller turns the phone (a commodity) into cash (money), completing the first stage of its transformation.

- From Money to Commodity: The cash earned from the sale is then used to purchase other goods, perhaps paying the manufacturer for more phones or the worker’s wages. Each time money is used in this way, it completes the cycle for that particular item.

This C–M–C process (Commodity-Money-Commodity) is more than just buying and selling; it’s a continuous exchange that fuels production and consumption. But what’s crucial here is that each stage of transformation connects to the next, leading to a chain of dependency that keeps the economy humming.

Money: The Glue Binding the System Together

Unlike direct barter, where you trade goods directly (say, wheat for linen), money allows these exchanges to happen across time, space, and participants. Your phone purchase might indirectly finance someone’s dinner across the world. This flexibility has a cost: it splits buying from selling, creating separate acts that can happen independently of each other. This separation has real consequences.

Take the weaver from Marx’s example. When he sells linen for money, that sale has to lead to another purchase for the cycle to continue. But if there’s a gap—a delay before the weaver spends the money—other exchanges might stall. This disconnection can ripple through the system, causing a shortage of demand or a pile-up of unsold goods.

Why Money Is Both Solution and Source of Crises

When commodities change hands in a cash-based society, each sale sets up the next purchase. However, Marx pointed out that these linked acts are vulnerable to disruption. Let’s say a farmer sells wheat but decides to save the cash rather than immediately spending it. The local baker, who depends on that sale to buy flour, now faces a delay. Multiply this effect across markets, and you have the groundwork for a crisis: an imbalance between supply and demand.

If these delays accumulate, they reveal the “contradictions” inherent in our economic system—contradictions like:

- Production without guaranteed consumption: A producer has no guarantee their goods will sell, meaning labor and resources could go to waste.

- Labor as both individual and social: While a worker produces individually, their work depends on and is aimed at meeting the collective needs of society. When these needs don’t align, the system stumbles.

- Value that relies on social agreement: Prices signal value, but they’re based on a social process of supply, demand, and labor that can shift without warning.

Marx suggested that this instability is built into the very nature of exchange. The act of buying and selling works only when all parts of the chain flow smoothly. Yet, as we see during economic downturns, this chain is anything but guaranteed.

How the Circuit of Commodities Shapes Our Economy

In the context of everyday life, these ideas might seem abstract. But think of a typical day: you might buy groceries, pay a phone bill, or stream a movie. Each transaction you make depends on a preceding chain of exchanges. If the farmer who grew the produce or the tech company that developed the streaming app encounters financial strain, it trickles down to your daily expenses.

Here’s how the commodity circuit (C–M–C) shapes this chain:

- Goods Enter the Market: A company produces items, let’s say linen, with the goal of selling.

- Goods Become Money: The linen is sold, becoming cash in the producer’s pocket.

- Money Buys More Goods: The cash earned from linen sales goes to buy other commodities, such as food or equipment, restarting the cycle.

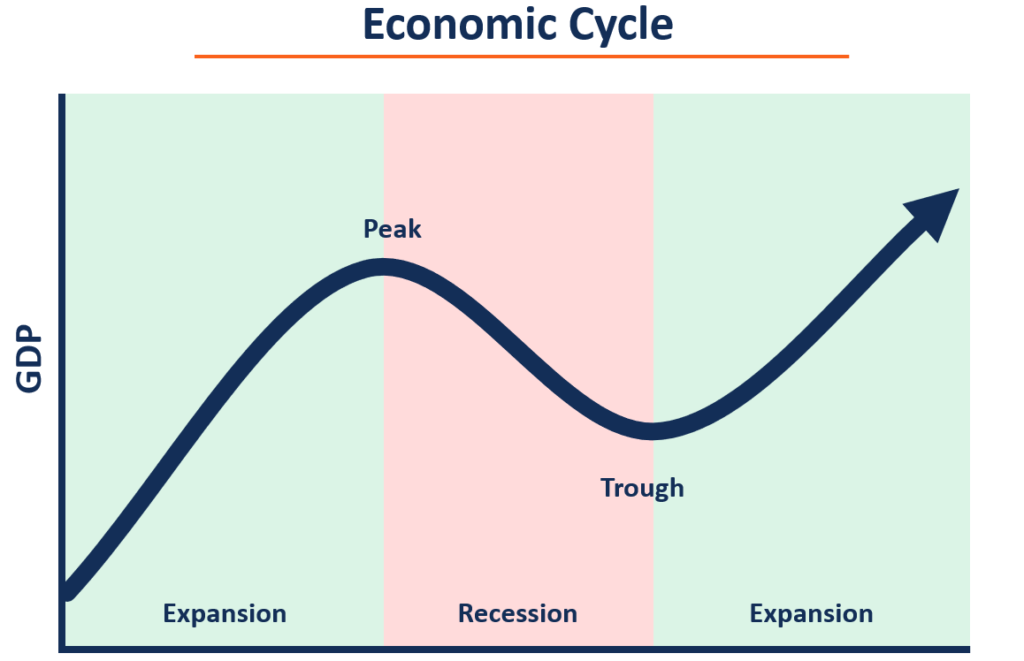

If the flow of money slows down—like in a recession—this entire cycle is thrown off balance. Instead of a smooth exchange, money can pile up with some people while others face shortages, highlighting how fragile our reliance on continuous buying and selling really is.

The Big Picture: Why Understanding This Matters Today

Marx’s analysis of money’s role in circulation offers a framework for understanding why economies grow or collapse. By splitting the acts of buying and selling, money allows flexibility but also brings risk. This delicate balance is why, even in today’s complex financial systems, we experience recessions, inflation, and other economic pressures when the chain of exchanges is interrupted.

Understanding commodity metamorphosis shines a light on our collective interdependence. Every exchange, whether it’s your morning coffee or a major tech purchase, is part of a broader network. This continuous transformation of goods to money to goods again is a process that keeps economies thriving but also holds the seeds of crisis.

In short, the next time you purchase a product, remember: you’re participating in a system that binds every buyer to a seller, every seller to a buyer, across the entire economic web. Each transaction is both simple and complex, a small part of a massive cycle that fuels modern society—until something causes it to slow down.

Open a trading account with a Broker right now

Read the Risk Warning before you register

Find more interesting stories and news about investments on our subreddit XGramatikInsights.

Risk Warning: Trading Forex and Leveraged Financial Instruments involves significant risk and can result in the loss of your invested capital. You should not invest more than you can afford to lose and should ensure that you fully understand the risks involved. Trading leveraged products may not be suitable for all investors. Before trading, please take into consideration your level of experience, investment objectives, and seek independent financial advice if necessary. It is the responsibility of the Client to ascertain whether he/she is permitted to use the services of the website based on the legal requirements in his/her country of residence.